The leading accountants in Leeds for restaurants, cafes, and takeaways

Based on 90 Reviews

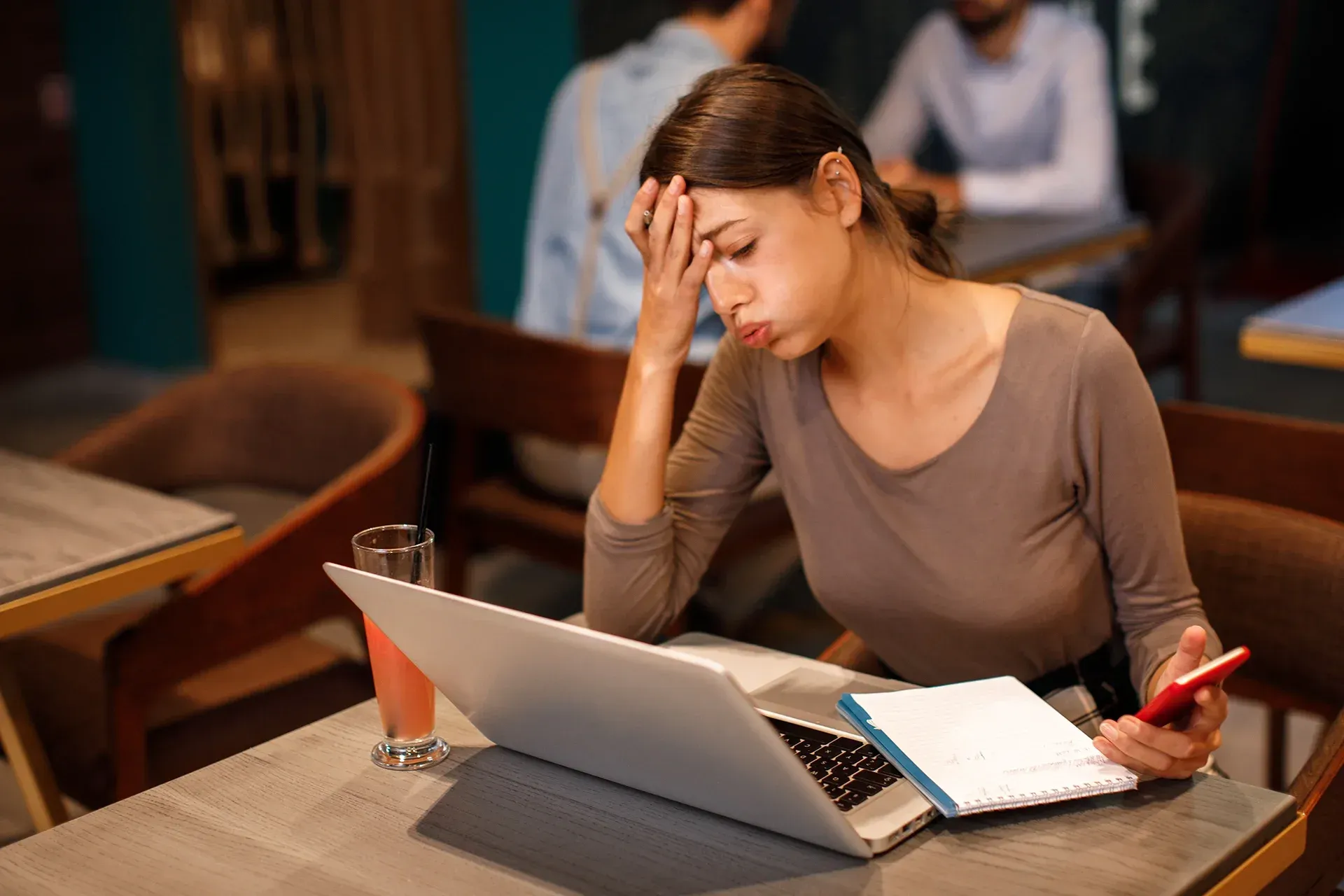

Take the burden off your shoulders

You didn’t start your restaurant or cafe business because you wanted to stress over handling financial records, audits, and taxes. You started because you love cooking, experimenting with new dishes, and watching the smiling faces of your customers as they enjoy your dishes.

But now you’re faced with the stress of doing all these things yourself to keep your business alive and running smoothly. Well, what if you didn’t have to do it yourself?

Accountants for restaurants, cafes, and takeaways

Are you a food service business? Leave the accounting to the experts while you run your business in peace.

Restaurants and Cafes

We partner with restaurants and cafes of all sizes, providing expert accounting support to help manage finances and improve profitability.

Takeaways

We work with independant takeaway owners, who are looking for reliable support with VAT, payroll, and cash flow management.

Let us do it for you

At MSF Associates accountants in Leeds, we are qualified professional accountants with years of experience serving the hospitality industry and delivering excellent service to our clients. This is why we understand you perfectly and know just how to help you.

We’ve made it our mission to not just give you what you need but what you want. You deserve to run your business without worrying over your finances. And we are here to give you the advice and more in-depth details as to why and how we get the figures we present, and what you can actually do in the future to put yourself in a better position.

How we help

Bookkeeping and Accounts

We keep your financial records up to date and within HMRC adequate records requirements.

Business Compliance Review

We analyse your records, interpret the data, and provide clear advice to guide the decisions that drive your success.

Tax Investigations

We make investigations into the UK's tax regulations and keep you informed so you never pay more taxes unexpectedly.

Payroll

Ensuring that your staffs are paid on time and regulating your staffing costs to keep you profitable.

VAT

Helping you understand which foods are subject to VAT and ensuring your VAT returns are filed correctly.

Research and Development

Identifying eligible expenditure within your business. Helping ensure you claim back as much as possible.

Get started with us

Step 1

To get the process started, book a meeting with an expert from our team

Step 2

On the meeting we will discuss our plan to help you streamline your business

Step 3

We sign you up into our client portal and give you absolute peace of mind

Free Download

Five Biggest Money Mistakes Food Service Businesses Make

(and how to avoid them!)

This eBook highlights the five biggest financial mistakes food and hospitality businesses make and offers practical steps to avoid them, helping you stay out of the 60% that fail in their first year and build a thriving, successful business.

Our promises to you

Timely reports and transparency

Quick and friendly customer service

Peace of mind about your finances

Proper taxes

Proper expert advice

Advice on how to ensure maximum profits

Book a call with an expert

Be the happy, free, passionate and successful restaurant owner. Leave the tedious financial jargon to us. Work with MSF Associates today!

Latest Articles